Vanadium

Last updated:19 December 2023

Please note that this page is currently under review.

Resource figures are current as at 31 December 2017.

Vanadium (V) is a soft, ductile, silver-grey metal that is primarily used with iron to make metal alloys for high-strength steel production. High-strength steel has a wide range of applications, including for gas and oil pipelines, tool steel, jet engines, the manufacture of axles and crankshafts for motor vehicles, as well as for reinforcing bars in building and construction.

Vanadium is also used in the production of ceramics and electronics, textile dyes, fertilisers, synthetic rubber, welding, as well as in alloys used in nuclear engineering and superconductors. Vanadium chemicals and catalysts are used in the manufacture of sulfuric acid, the desulfurisation of sour gas and oil, and in the development of fuel cells such as vanadium redox flow batteries and low-charge-time, lightweight batteries.

Vanadium is not found in its metallic form in nature but occurs in more than 60 minerals as a trace element in a range of rock types. It occurs most commonly in titaniferous magnetite deposits and in uraniferous sandstone and siltstone, as well as bauxites and phosphorites. Vanadium also occurs in fossil fuels such as crude oil, coal and tar sands.

Nearly all of the world's vanadium is derived from mineral concentrates (typically vanadium-rich and titanium-rich magnetite) separated from mined ore, or as a by-product of steel-making slags. According to the United States Geological Survey (USGS)1, China, South Africa and Russia are the world's main producers of vanadium. Petroleum residue is another source of vanadium. Japan and the United States are understood to be the only countries to recover significant quantities of vanadium from this source. It is also recovered from wastes such as fly ash from coal combustion and waste solutions from the processing of uranium ores.

Vanadium is sold as vanadium pentoxide (V2O5) and, less commonly, as vanadium trioxide (V2O3) for non-steel applications and as the alloy ferrovanadium (FeV) for steel making. The most common FeV alloy is FeV80, but FeV40, FeV50 and FeV60 are also sold. The numeric part of the symbol refers to the amount of contained vanadium for example, FeV80 contains approximately 80% vanadium.

Trade in vanadium products tends to be opaque with no central market recording prices. Various trade sheets such as the Metal Pages, Ryan's Notes and the London Metal Bulletin record proprietary information for subscribers.

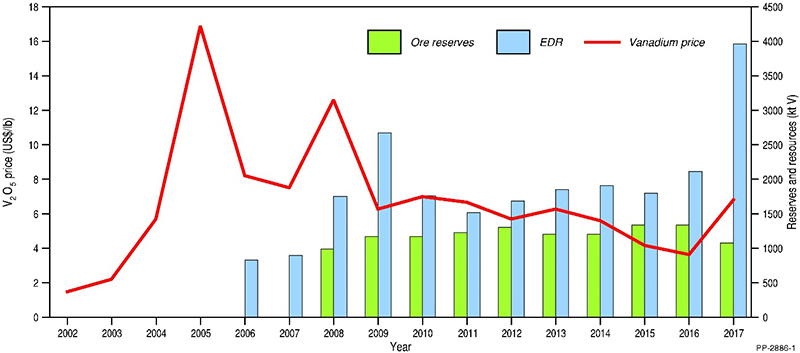

The vanadium market has always been linked to the steel industry, making it economically vulnerable owing to its sensitivity to market demand by developing countries. Figure 1 shows the price volatility of the vanadium market from 2002 to 2017. Of note, is the price surge from US$5.70 in 2004 to US$16.89 in 2005. This increase was related to the growth of global steel production that caused an increase in vanadium consumption and a commensurate depletion of stockpiles. Similarly, Australia’s reserves and resources of vanadium have also fluctuated over the years in response to the volatile nature of the vanadium market (Figure 1).

The USGS2 cited the small number of vanadium projects being commissioned in recent years. However, this is rapidly changing as development of battery storage technology grows globally, favouring a rising interest in vanadium. Correspondingly, increased development activities of vanadium projects in Australia are also taking place in anticipation of the prospect of high future demand. This future market anticipation has also influenced the rise of the vanadium price during and beyond the period of 2017. The USGS reported an average price of vanadium pentoxide in September 2017 at US$5.05 per pound, an increase of over 50% from 2016 values which were $US3.38 per pound3. The USGS also noted the high price of ferrovanadium in September 2017 reaching $21.10 per pound4. Environmental issues have led to the closure of vanadium operations in China as it tries to address pollution. This has had a bullish effect on the price of vanadium pentoxide and, to an extent, on ferrovanadium as current availability has declined.

JORC Reserves

In 2017, Proved and Probable Ore Reserves of vanadium, compliant with the Joint Ore Reserves Committee (JORC) Code, was approximately 1075 kilotonnes (kt; Table 1). Proved and Probable Ore Reserves account for approximately 27% of Economic Demonstrated Resources (EDR; Table 2). The remaining 73% of EDR comprises Measured and Indicated Resources.

Table 1. Australia's vanadium Ore Reserves and production, 2002-2017.

| Year | Ore Reserve1 (kt V) | Production2 (kt V) |

|---|---|---|

| 2017 | 1075 | 0 |

| 2016 | 1341 | 0 |

| 2015 | 1341 | 0 |

| 2014 | 1208 | 0 |

| 2013 | 1208 | 0.40 |

| 2012 | 1305 | 0.07 |

| 2011 | 1230 | 0 |

| 2010 | 1172 | 0 |

| 2009 | 1172 | 0 |

| 2008 | 991 | 0 |

| 2007 | 5.3 | 0 |

| 2006 | 0 | 0 |

| 2005 | 0 | 0 |

| 2004 | 0 | 0 |

| 2003 | 0 | 0.389 |

| 2002 | 0 | 3.14 |

kt V = thousand tonnes of vanadium content.

- The majority of Australian Ore Reserves and Mineral Resources are reported in compliance with the JORC Code, however there are a number of companies that report to foreign stock exchanges using other reporting codes, which are largely equivalent. In addition, Geoscience Australia may hold confidential information for some commodities.

- Source: Industry reports. Production data often have a higher level of certainty than resource estimates and so may be presented with more significant figures.

Identified Resources

Australia's EDR of vanadium increased by 88% to 3965 kt in 2017, up from 2111 kt in 2016 (Table 2). Inferred Resources, on the other hand, decreased by approximately 27% in 2017. This has mainly occurred because project owners have shown increasing interest in developing their dormant vanadium projects, embarking on drilling programmes to upgrade existing resources (mostly Inferred to Indicated and Measured) to advance the development stage.

Accessible EDR

Some mineral resources are inaccessible for mining because of environmental restrictions, government policies or because they occur within military lands or national parks. All of Australia’s EDR of vanadium are considered to be accessible.

Table 2. Australia's identified vanadium resources and world figures (kt V) for selected years, 1990-2017.

| Year | Demonstrated Resources | Inferred Resources2 | Accessible EDR3 | Australian Mine Production4 | World Economic Resources5 | World Mine Production5 | ||

|---|---|---|---|---|---|---|---|---|

| Economic (EDR)1 | Paramarginal | Submarginal | ||||||

| 2017 | 3965 | 10 854 | 1376 | 12 412 | 3965 | 0 | 21 500 | 80 |

| 2016 | 2111 | 14 677 | 1376 | 17 002 | 2111 | 0 | 19 000 | 76 |

| 2015 | 1802 | 14 677 | 1688 | 16 633 | 1802 | 15 000 | 79.4 | |

| 2014 | 1910 | 14 640 | 1687 | 16 412 | 1910 | 15 000 | 78 | |

| 2013 | 1853 | 14 640 | 1534 | 16 163 | 1853 | 0.4 | 14 000 | 76 |

| 2012 | 1684 | 14 640 | 1759 | 16 591 | 1684 | 0.07 | 16 000 | 63 |

| 2011 | 1519 | 10 324 | 1713 | 10 544 | 1519 | 15 000 | 62 | |

| 2010 | 1762 | 10 324 | 1533 | 8447 | 1762 | 15 400 | 56 | |

| 2009 | 2673 | 8629 | 1279 | 5117 | 2673 | 15 673 | 54 | |

| 2008 | 1750 | 10 | 4124 | 3759 | 1750 | 13 000 | 60 | |

| 2007 | 898 | 121 | 4124 | 2757 | 898 | 13 000 | 58.6 | |

| 2006 | 832 | 213 | 1710 | 3051 | 13 000 | 62.4 | ||

| 2005 | 0 | 777 | 1810 | 2476 | 13 000 | 42.5 | ||

| 2000 | 188 | 1736 | 491 | 3631 | 0.28 | 10 000 | 42 | |

| 1995 | 15 | 1739 | 8425 | 2282 | 10 000 | 35 | ||

| 1990 | 46 | 1490 | 8425 | 2359 | 4268 | 31.8 | ||

kt V = thousand tonnes of zinc content.

- Economic Demonstrated Resources (EDR) predominantly comprise Ore Reserves and most Measured and Indicated Mineral Resources that have been reported in compliance with the Joint Ore Reserves Committee (JORC) Code to the Australian Securities Exchange (ASX). In addition, some reserves and resources have been reported using other reporting codes to foreign stock exchanges and Geoscience Australia may hold confidential data for some commodities.

- Total Inferred Resources in commercial, potentially commercial, non-commercial and undifferentiated categories.

- Accessible Economic Demonstrated Resources (AEDR) is the portion of total EDR that is accessible for mining. AEDR does not include resources that are inaccessible for mining because of environmental restrictions, government policies or military lands.

- Source: Industry reports. Production data often have a higher level of certainty than resource estimates and so may be presented with more significant figures.

- Source: United States Geological Survey (Mineral Commodity Summaries)5.

Exploration

Data on exploration expenditure for vanadium is not available in published statistics. However, individual resource companies have published exploration information. Neometals Ltd, for example, is actively exploring a ferrovanadium-titanium deposit hosted within the Barrambie Igneous Complex, which is a large, layered, mafic intrusive complex of the Meeline Suite that occurs along a narrow, NNW-SSE trend of the Archaean Barrambie Greenstone Belt in the northern Yilgarn Craton.

Neometals drilled over 5000 m utilising reverse circulation (RC) and diamond drilling during 2017 (2912 m) and 2018 (2681 m) at the project with diamond drilling focused on drilling within a defined resource area intended for metallurgical test work. The RC drilling targeted the strike extensions and the parallel structures. The company reported some of drilling’s significant intersections, including 71 m at 33.4% TiO2, 0.8% V2O5 and 53 m @ 29.4% TiO2, 0.7% V2O5.

Neometals is also exploring other prospective deposits within the Barrambie project, including the Virginia Hills prospect, which returned an initial drill intersection of 19 m at 16.4% TiO2 and 0.40% V2O5. The prospect is located approximately 5 kilometres (km) to the west of Barrambie and is interpreted as a folded limb of the Barrambie deposit.

Australian Vanadium Ltd is also exploring the Barrambie Igneous Complex and reported the completion of 14 RC drill holes totalling 1089 m and three diamond drill holes for 383 m at their Gabanintha deposit. Australian Vanadium has reported some of the drilling’s significant intersections, including 26 m at 0.94% V2O5 and 61.9% Fe2O3 from 47 m depth and 17 m at 1.14% V2O5 and 66.5% Fe2O3 from 81 m depth. The company further stated that the majority of the drill holes were infill drilling at the resource defined areas to increase confidence and to upgrade the Inferred to Indicated Resources.

Immediately to the north and southeast of the Australian Vanadium project, Technology Metals Australia Ltd hold exploration tenements where they have conducted drilling programmes over the northern and southern blocks of their Gabanintha Vanadium Project. Technology Metals completed 13 diamond drill holes for a total of 1235 m with drilling results confirming the continuity of the high-grade mineralisation of the previously reported resources at the project’s northern block. Some of the drilling’s significant intersections at the Northern Block deposit include 27.5 m at 1.04% V2O5, 11.8% TiO2 and 47.3% Fe and 73 m at 0.71% V2O5, 8.4% TiO2 and 27.4% Fe. Correspondingly, at the company’s Southern Block deposit, an Inferred Resource was delineated from the 2232 m drilled from 23 RC holes. Some significant intersections from the this drilling include 17 m at 0.73% V2O5, 8.5% TiO2 and 34% Fe from 18 m depth and 52 m at 0.89% V2O5, 10.2% TiO2 and 39.8% Fe from 77 m depth.

Coziron Resources Ltd initiated 3800 m of RC drilling at its Buddadoo project. The main target of the drilling program was to define vanadium, titanium, copper and nickel mineralisation. Another objective of the programme was to obtain samples for geochemical analysis to test some historically high vanadium (1.7% V2O5) and titanium (20% TiO2) occurrences associated with magnetic anomalies near the eastern margin of a gabbro in the Buddadoo Range.

Production

There are currently no operating vanadium mines in Australia although new grass-roots projects are advancing toward production (see Industry Developments below). The most recent mining activity for vanadium in Australia was carried out at Atlantic Ltd’s Windimurra Vanadium Project, which was suspended in 2014. Driven by new battery storage technologies, the present momentum of the vanadium market has spurred new exploration as well as encouraged mining feasibility studies of mothballed projects.

World Ranking

The USGS estimates that world economic resources of vanadium are about 19 million tonnes (Mt) but total world resources exceed 63 Mt. China dominates world vanadium resources with 42% followed by Russia at 23%, and Australia at 18% (Table 3). However, because vanadium can be recovered as a by-product or a co-product of steel slags, the estimated world resources are not fully indicative of available supply.

The USGS estimates that world production of vanadium from all sources in 2017 totalled more than 80 kt compared to 79 kt in 2016, with China producing 43 kt, Russia 16 kt and South Africa 13 kt (Table 4).

Table 3. World economic resources of vanadium 2017.

| Rank | Country | Economic Resources (kt V) | Percentage of World Total |

|---|---|---|---|

| 1 | China | 9000 | 42% |

| 2 | Russia | 5000 | 23% |

| 3 | Australia | 3965 | 18% |

| 4 | South Africa | 3500 | 16% |

| 5 | USA | 45 | <1% |

| Total | 21 510 |

kt V = thousand tonnes of zinc content.

Source: United States Geological Survey6 and Geoscience Australia. National figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Table 4. World production of vanadium 2017.

| Rank | Country | Vanadium (kt V) | Percentage of World Total |

|---|---|---|---|

| 1 | China | 43 000 | 53% |

| 2 | Russia | 16 000 | 20% |

| 3 | South Africa | 13 000 | 16% |

| 4 | Brazil | 8400 | 10% |

| Total | 80 400 |

kt V = thousand tonnes of vanadium content.

Source: United States Geological Survey7. National figures other than Australia are rounded. Percentages are also rounded and might not add up to 100% exactly.

Industry Developments

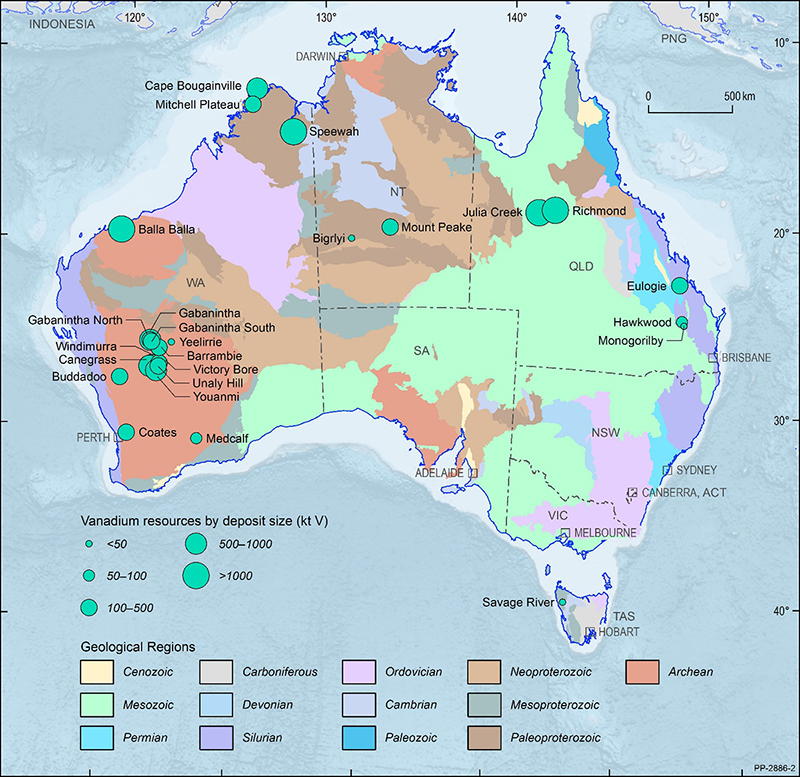

This section highlights the recent company exploration and development-related activities occurring at leading vanadium projects. Global demand differs for each type of commodity and, as the technology in battery storage advances, so does the interest in vanadium. Present high interest in vanadium is reflected in some greenfield vanadium projects through increased exploration drilling and technical studies as project owners anticipate advancing their projects into production. All reported reserves and resources are compliant with the JORC Code unless otherwise stated. Major deposits are shown in Figure 2 on a total resource basis.

Figure 2. Australian vanadium deposits as at 31 December 2017.

kt V = thousand tonnes of vanadium content. Resource size is based on total resources (Measured + Indicated + Inferred, inclusive of Ore Reserves).

Mount Peak: TNG Ltd's Mount Peake iron-vanadium-titanium project is located in the highly prospective Arunta Geological Province some 80 km northeast of Alice Springs in the Northern Territory. It is hosted by the non-outcropping Mount Peake Gabbro.

An updated feasibility study for the project was released during the last quarter of 2017 with a new capital expenditure estimate of $853 million8, significantly lower than the $970 million estimated in the 2015 definitive feasibility study9. The project has also gained some environmental regulatory approvals from the Federal and Northern Territory Governments, advancing it closer to development10.

The project has an estimated JORC Ore Reserve of 41.1 Mt at 0.42% V2O5, 7.99% TiO2 and 28% Fe, which is derived from JORC Mineral Resources of 160 Mt at 0.28% V2O5, 5.3 % TiO2 and 23% Fe previously released in 201311.

Cambridge: Liontown Resources Ltd conducted a comprehensive review of historical data and rock-chip sampling from the Cambridge deposit, which occurs within the company’s Toolebuc Vanadium Project, located approximately 440 km east of Townsville in northwest Queensland. The review has defined some significant intersections, including a 4 m interval at 0.48% V2O5 from 15 m depth and a 2 m interval at 0.63% V2O5 from 16 m depth12. A maiden JORC 2012 Inferred Resource of 83.7 Mt at 0.30% V2O5 and 188 ppm of MoO3 has been delineated from the historical data and samples review13.

The Cambridge deposit is hosted by the Toolebuc Formation (the main host of vanadium mineralisation) under the Wilgunya Subgroup and is part of the Cretaceous Rolling Downs Group.

Debella: Vecco Group aims to produce high-grade vanadium electrolyte for vanadium redox flow batteries for energy storage from its Debella Vanadium Project. The project’s drilling programs in 2018 delivered some significant high-grade intersections including 0.80%, 0.73%, 0.75%, 0.67% and 0.77% V2O514. The company’s website states that the Dabella Vanadium Project has total resources of approximately 175 Mt at average grade of 0.45% V2O515. The total resource is inclusive of Indicated resources of approximately 45 Mt at an average grade of 0.47% V2O5.

Vecco Group also reported the results of the project’s ore technical analysis which, according to the company, has shown product recoveries of 87%16. This will allow for a low-cost atmospheric leaching plant and vanadium production recovery processes.

The Debella high-grade vanadium mineralisation is hosted by the Cretaceous Toolebuc Formation under the Wilgunya Subgroup and is part of the Cretaceous Rolling Downs Group. The project is approximately 80 km north-northeast of Julia Creek and 245 km east of Mount Isa, Queensland.

Richmond: Intermin Resources Ltd and its joint venture partner, AXF Vanadium Pty Ltd, have reported an upgrade of resources in compliance with the JORC 2012 guidelines at their Richmond vanadium-molybdenum project17. The resource upgrade was the result of a drilling program (of approximately 2579 Mt at an average grade of 0.32% V2O5 and 262 g/t MoO3) and beneficiation test work at four deposits

The Richmond project is located in central North Queensland, 250 km east of Mount Isa. The project’s vanadium deposits are hosted by the Cretaceous Toolebuc Formation under the Wilgunya Subgroup and are part of the Cretaceous Rolling Downs Group.

Barrambie: Neometals Ltd reported an update for its Barrambie ferrovanadium-titanium project of 280.1 Mt at 0.44% V2O5 and 9.18% TiO218, resulting from their 2017 and 2018 drilling programs. The company stated that it is continuing to evaluate its development options for Barrambie, considering either direct shipping ore or integrated titanium-vanadium production19. The project is located approximately 65 km north-northwest of Sandstone in Western Australia, and is hosted by the Meeline Suite of layered mafic intrusions.

Buddadoo: Coziron Resources Ltd reported the completion of its RC drilling programme at its Buddadoo vanadium project20. Drilling commenced and concluded during the first quarter of 2018. Significant intersections include 77 m at 0.22% V2O5, 56 m at 0.26% V2O5 and 88 m at 0.22% V2O521.

The project is located in the Murchison Province of the Yilgarn Craton and is approximately 200 km east of Geraldton in Western Australia. The mineralisation is hosted by the Buddadoo gabbro, a part of the Meeline Suite.

Canegrass: Flinders Mines Ltd reported an upgraded vanadium resource (Inferred) of 79 Mt at 0.64% V2O5 at the Fold Nose and Kinks deposits22, part of its Canegrass vanadium project. Canegrass is located 15 km southwest of Atlantic Ltd.’s Windimurra deposit and 60 km southeast of Mount Magnet and is also hosted by the Meeline Suite of layered mafic units.

Gabanintha: In 2018, Australian Vanadium Ltd reported the results of the RC and diamond infill drillings conducted at its Gabanintha Vanadium Project, which confirms the continuity and thickness of the vanadium-magnetite mineralisation along the existing defined JORC Measured and Indicated Resource area23. In late 2018, the company released the results of its prefeasibility study including a maiden Ore Reserve amounting to 18.24 Mt at 1.04% V2O524 , part of a total Mineral Resource of 183.60 Mt at 0.76% V2O525. Australian Vanadium stated that technical information resulting from this drilling program will be utilised to finalise the Gabanintha project’s prefeasibility study26.

Gabanintha is located some 440 km northeast of Geraldton in the mid-West region of Western Australia.

Gabanintha North and Gabanintha South: Technology Metals Australia Ltd’s Gabanintha project is immediately to the north and southeast of the Australian Vanadium project of the same name. In 2017, Technology Metals reported a maiden JORC Inferred Resource of 62.8 Mt at 0.8% V2O5 for its Gabanintha Vanadium Project, derived from a 36-hole RC drilling program27. The company’s resource report highlighted a much higher grade component of the mineralised resource zone of approximately 29.5 Mt at 1.1% V2O5.

Another highlight for Technology Metals in 2017 was the successful delineation of the project’s Southern Block which has a maiden Inferred Resource of 21.5 Mt at 0.9% V2O5, 10.1% TiO2 and 39.3 % Fe, resulting from a previously reported 23-hole RC drilling program28.

Speewah: The scoping study for the Speewah Vanadium Project, completed in 2018, implied that the project is economically feasible for further development29. King River Copper Ltd (now King River Resources Ltd) stated that the study also showed that consideration to incorporate present market conditions and processing technologies being trialled will improve the project’s cost-benefit analysis30.

The Speewah pre-scoping concept study initially investigated the project’s capacity to produce vanadium pentoxide at a grade between 99.5% to 99.9% V2O5, titanium dioxide at >99% TiO2 and iron at >68% Fe31. In May 2017, King River reported JORC (2012) Measured, Indicated and Inferred Resources of 4712 Mt at 0.3% V2O5, 2.0% Ti and 14.7% Fe for the project32.

Mineralisation occurs within three vanadium-titanium bearing magnetite deposits within a gabbro unit of the Hart Dolerite sill intrusion in the Speewah Dome. These are the Central, Buckman and Red Hill deposits. The Speewah Project is located in the Kimberley region of Western Australia, approximately 100 km south of Wyndham.

Unaly Hill: Surefire Resources NL (previously Blackridge Mining Ltd) announced the initiation of its new diamond drilling programme at the Unaly Hill Vanadium Project which is located approximately 48 km south of Sandstone in Western Australia33.

Surefire expects to acquire drill core for metallurgical and geochemical analysis that will include a comprehensive study of the project’s rock types and mineralisation styles. The second phase of the drilling program will be aimed at the untested magnetic anomalies.

The project’s iron-titanium-vanadium resources remain unchanged since the 2011 estimate of an Inferred Resource of 86.2 Mt at 0.4% V2O5, 4.5% TiO2 and 24% Fe34.

The Unaly Hill tenements are hosted by the Atley Igneous Complex, a unit of the Meeline Suite of layered mafic units.

Windimurra: Atlantic Ltd completed a recommencement study and is currently undertaking an engineering study for recommissioning operations at its Windimurra Vanadium Project, with the aim for initial production in 202035. The company said that the study focused on upgrading site infrastructure subsequent to an extensive geometallurgical test work program. The project’s recommissioning study has projected a capital cost of $127 million for an initial mine life of approximately 25 years. The Windimurra operation is expected to produce V2O5 at a capacity rate of 7750 tonnes per annum.

Windimurra is located approximately 670 km north of Perth and 80 km by road from Mount Magnet in Western Australia. Geologically, the Windimurra deposit lies within the eastern flank of the large (>2000 km²) Windimurra intruded layered gabbro complex, which is part of the regional Murchison granite-greenstone province. The resource deposits have total mineral resources of approximately 235 Mt at 0.49% V2O536. The resource is inclusive of JORC Proved and Probable Ore Reserves of approximately 55 Mt at 0.49% V2O537.

Citation

Bibliographical reference: Summerfield, D., 2019. Australian Resource Reviews: Vanadium 2018. Geoscience Australia, Canberra. http://dx.doi.org/10.11636/9781925848274

References

2 See Footnote 1.

3 ibid

4 ibid

5 See Footnote 1.

6 See Footnote 1.

7 ibid

8 TNG Ltd. Mount Peake updated feasibility study ASX Release 20 November 2017.

9 TNG Ltd. Mount Peake Feasibility Study results ASX Release 31 July 2015.

10 TNG Ltd. Annual Report 2015.

11 TNG Ltd. ASX Release 18 March 2013.

12 Liontown Resources Ltd. ASX Release 23 April 2018.

13 Liontown Resources Ltd. ASX Release 30 July 2018.

14 VECCO Group.

15 See Footnote 11.

16 VECCO Group. Website announcement.

17 Intermin Resources Ltd. ASX Release 8 May 2018.

18 Neometals Ltd. ASX Release 17 April 2018.

19 Neometals Ltd. ASX Release 24 January 2018 and 17 April 2018.

20 Coziron Resources Ltd. ASX Release 15 May 2018.

21 ibid.

22 Flinders Mines Ltd. ASX Release 30 January 2018.

23 Australian Vanadium Ltd. ASX Release 30 October 2018.

24 Australian Vanadium Ltd. ASX Release 19 December 2018.

25 Australian Vanadium Ltd. ASX Release 28 November 2018.

26 See Footnote 24.

27 Technology Metals Australia Ltd. ASX Release 13 June 2017.

28 Technology Metals Australia Ltd. ASX Release 15 December 2017.

29 King River Copper Limited. ASX Release 1 November 2018.

30 ibid.

31 King River Copper Limited. ASX Release 20 June 2018.

32 King River Copper Ltd. ASX Release 26 May 2017.

33 Surefire Resources NL. ASX Release 13 June 2018.

34 Black Ridge Mining Ltd. ASX Release 21 November 2011.

35 Atlantic Pty Ltd. Website announcement.

36 Atlantic Pty Ltd. Website announcement.

37 See Footnote 32.